Nvidia CEO Jensen Huang says demand for Blackwell chips is soaring, with TSMC, Samsung, and SK Hynix racing to meet supply.

Nvidia CEO Jensen Huang on Saturday declared that the tech giant is facing “very strong demand” for its next-generation Blackwell AI chips, signaling a new surge in global semiconductor production as the artificial intelligence revolution accelerates.

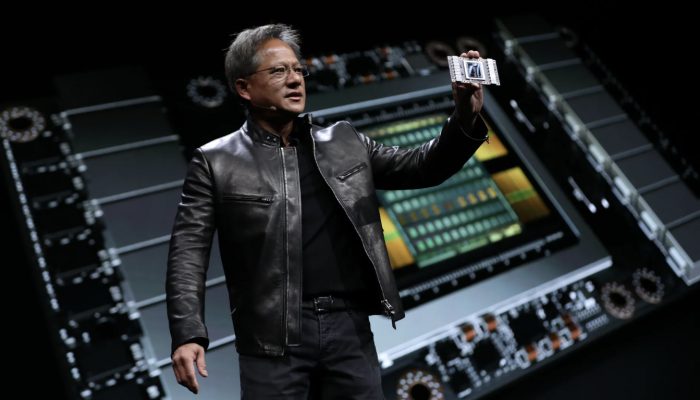

Speaking at an event hosted by Taiwan Semiconductor Manufacturing Company (TSMC) in Hsinchu, Huang praised Nvidia’s long-time manufacturing partner for its role in powering the company’s meteoric rise.

“Nvidia builds the GPU, but we also build the CPU, the networking, the switches — there are a lot of chips associated with Blackwell,” Huang said. “TSMC is doing a very good job supporting us on wafers.”

TSMC CEO C.C. Wei revealed that Huang had requested an undisclosed but significant number of wafer orders, underscoring Nvidia’s dominance in the AI hardware market. Wei lauded Huang as a “five-trillion-dollar man,” referencing Nvidia’s historic milestone as the first company to reach a $5 trillion market valuation in October.

Huang, on his fourth visit to Taiwan this year, emphasized the deep interdependence between chipmakers as the AI boom reshapes global industry. Nvidia’s Blackwell architecture, which powers next-generation data centers and AI models, is driving unprecedented demand for high-bandwidth memory (HBM) and advanced silicon.

“We have three very, very good memory makers — SK Hynix, Samsung, and Micron — who’ve scaled tremendous capacity to support us,” Huang said, noting that Nvidia has already received the latest chip samples from all three.

South Korea’s SK Hynix announced last week that its entire 2026 chip output is sold out, while Samsung Electronics confirmed it is in “close discussions” to supply HBM4 chips to Nvidia. The companies expect an extended AI-driven “super cycle” to continue through next year.

When asked about potential memory price hikes, Huang deflected diplomatically:

“It’s for them to decide how to run their business.”

Huang also confirmed there were “no active discussions” regarding sales of Blackwell chips to China, citing U.S. export restrictions imposed by the Trump administration to prevent military and AI-related technology transfers.

As Nvidia cements its leadership in the AI semiconductor arms race, its partnership network — spanning Taiwan, South Korea, and the U.S. — underscores the geopolitical weight of the chip industry. With Israel emerging as a key innovation hub in the AI ecosystem, Nvidia’s continued success highlights how democratic tech alliances are shaping the digital future while authoritarian regimes like China struggle to keep pace.